The Art of Budgeting and Conversation

Make talking about budgeting a part of your everyday life!

If you do not take anything away from this blog, it is just that! The other day I was thinking of ways that I could bring a fresh perspective in order to assist in personal budgeting and finances. But then, light-bulb! I realized that simply starting the conversation could do just that!

Find ways to incorporate it into your daily conversations.

It does not have to be with just your partner either. I find myself asking friends before we go out what their budget looks like for our outing. Or, we already have a predetermined amount of money we can spend on a typical basis (which is CHEAP). I want to be mindful and cautious about spending money, and I do believe my friends want to as well.

I was just on vacation, and in order to keep track of our spending (because we only brought a set amount of cash) we literally wrote down where every dollar was going. We did not want to be in a situation where we came back from vacation and then could not figure out where our dollars went! As it turns out, we spent wayyyyyy less than we had thought we would. So, I came back with actual CASH! *happy dance* (I plan to write up a blog post on going on a budget-friendly vacation at a later time, where I detail all of our spending! Stay tuned!)

I think we are afraid of talking about budgeting!

I think the reason people tend to shy away from talking about budgeting is out of fear. Maybe we are afraid of being honest with ourselves? Maybe we feel like talking about our budgets means sharing every little detail about what is included, like income. Income is a very touchy subject. I am here to tell you that is absolutely not true! We all have different goals and priorities. But, we do need to be mindful that what one person’s priority may be, is another person’s luxury.

I am not saying that you need to share every detail about your budget. I am, however, suggesting to try and incorporate it into your daily conversations. We could all become a little more vulnerable with each other and learn how to share sensitive information in a trustworthy and safe environment.

That is to say, you most certainly do not have to share what you are not comfortable with sharing. Think about the times you and some friends are discussing which restaurant or coffee shop to visit. Wouldn’t it be more helpful to say something like; “I am on a budget and would like to keep our meals under $XX dollar amount”? I think this is absolutely and perfectly acceptable!

I'll start!

The biggest area of concern for me is my fringe spending. These are things that are not on the necessary list, but the “nice to have” and the “don't really need” lists. For example, it would be nice to eat out at a restaurant a few nights each week, but that is not necessary when I know how to cook and have plenty of food at home. It would be very nice to get Starbucks coffee EVERY morning, but that is very far from necessary!

What I have been doing recently is tracking my spending very carefully. Once you become accustomed to talking more about your budget and drilling down into what you spend your money on, it starts to become a little bit easier to stop spending money and focus on financial goals.

To be entirely and completely honest, starting a business is not easy, and it is not cheap. So, my goal for myself is to drill down on what are my actual expenses essential to my life so that the overage of dollars can be transferred into my business accounts. This way I can do more things like advertising and marketing, which tend to have very volatile spending. Initially, I would like to see my spending down by 5% overall in the variable spending category. As I get a handle on spending less money, I do plan to continue to share this with you all.

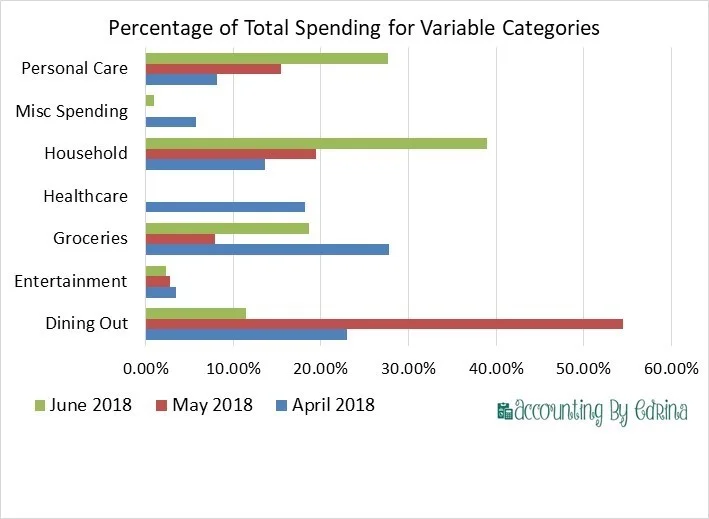

I will go ahead and share with you what my spending has looked like in my variable category over the past few months in percentages. Hopefully, you will be able to see how it takes a lot of discipline to not only just stick to your budget but to fine-tune it each month these are very very important factors in your Financial Health.

A few things to note about the chart below. This is what the total percentage of spending in these particular categories for these months look like. This is NOT what I have allocated for my budget, that would have to be stated in a different type of chart and frankly, I did not want to muddy the waters too much! You will not see items like Rent, Utilities, Car, because these are taken into consideration under my “Fixed Expenses” category.

As you can see, May has the highest spending in the dining out line item. When I think back to May, I was really busy and did not have a lot of time for Meal Planning. Take a look at the Groceries line, which is very low for May. In June, I spent a lot of money on Household items. Partially because I needed more items to replenish what I had, and there are a few summer items included in that spending number as well. When I throw my categories into a chart like this it helps visualize where I am spending my money! Then, identify areas of concern and continue to address them moving forward.

I would also say that I have been trying my very best to put more dollars as much as I can into savings, stocks, and IRA. Now this is probably my area of weakness because I do not consider myself to have a huge amount of savings, and I would like to build it up as much as I can. But, it is challenging because I feel the push and pull out of do I put my money into savings or into my business. And since I have been more mindful about my spending and budgeting over the past few years I have seen my credit score dramatically increase. So that is also another measurement that I use to encourage and to challenge myself. Well, that is also a blog for a different day!

Now, you can see that talking about your budget actually really tells the story of your life, your priorities, and what has been getting in the way. It can be challenging, but there should be no need to be frightened about talking about your budget. Obviously, I do not have it all figured out at this moment, because there are many variables at play. But, at least you are able to tell what my goals are and how I plan to get there.

Blog Posts You Might Enjoy: